The law has changed. All employers must provide a workplace pension – and contribute to it.

Mandatory Auto Enrolment commenced in 2012 for companies with over 250 employees and finally, in April 2017, this applied to companies with less than 30 employees or those without PAYE schemes. Now all employers have to have a qualifying pension scheme in place, whether their employees are eligible or not.

Auto Enrolment: headache or an opportunity?

As a business owner and depending on your view Auto Enrolment is either a pain that you can do without or an opportunity to be embraced.

From an HR perspective, we see this as a great employee engagement opportunity.

It’s our duty to encourage employees to save

Whilst the State Pension age set out by the government has been increased, (see https://www.gov.uk/state-pension-age for the latest information) so too has life expectancy, with many people now expecting to have over 20+ years enjoying their hard-earned retirement, or will they?

The government is actively encouraging people to save for their retirement, as it is recognised that the State Pension alone, will not be sufficient enough for those in their senior years to enjoy life. In fact, the State Pension is not designed to provide a good quality of life, rather keep people out of poverty.

For many years, so many people have had their head in the sand regarding their retirement, believing it to be so far off, they can think about it at a later stage in life. There are many examples around the world where countries are sitting on a pension time bomb and it is already having a detrimental effect on people’s welfare and living standards, so encouraging saving into a pension will better help to protect their own futures.

Sell the benefits of a pension to your employees

It’s the only way of saving for the future that gives your employees extra money from the Government and from you, their employer:

• The pension belongs to them and not their employer

• They can choose to pay in more if you want to

• They can choose where their money is invested (depending on the scheme you put in place)

• They can make changes

As an employer, it’s your way of helping your employee get the kind of retirement they want.

What are the Workplace Pension options for employers and employees?

There are of course various options, that both the employer and the employee can choose to take when considering a Workplace Pension. These range from the employee opting out completely, although they will be automatically enrolled again after 3 years, through to the employer providing a scheme for their employees that is a comprehensive, sophisticated pension, with all the added benefits that are available, to themselves and the employee alike.

Example Option 1

As a business owner and employer, you have to do something and this can be at no cost, such as NEST*. However, there is still a lot of ongoing administration and communications to staff. Failure to comply with communications is a finable offence.

Example Option 2

Alternatively, there are schemes that will carry out all the regulatory requirements for you. There is a fee for this, which is generally around £30-£40 per month. These schemes are straightforward and are better from an employee perspective than NEST.

Example Option 3

The next step is an insurance company scheme. Such schemes are more comprehensive with the potential for additional perks.

A Workplace Pension benefits your business

The Workplace Pensions should be treated as part of the employees’ remuneration package. Potential and existing employees will no doubt weigh up the pension scheme on offer, alongside other remuneration benefits. You can be sure they will be comparing it to your competitors’ packages.

An attractive benefit package will attract higher calibre candidates and keep existing staff loyal, which has a positive impact on the recruitment process and staff retention rates.

Are you grabbing this opportunity to engage with your employees?

How have you ‘sold’ Auto Enrolment and Workplace Pensions to your employees? Has it been a headache for you or have you embraced the opportunity? We’d love to know.

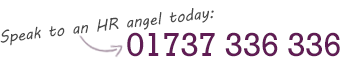

And, if you feel as though you would like some help on Workplace Pensions, please contact Charlie on 01737 336 336 or email us.

* The National Employment Savings Trust (NEST) Corporation is the trustee of the NEST occupational pension scheme. The scheme, which is run on a not-for-profit basis, ensures that all employers have access to suitable, low-charge pension provision to meet their new duty to enrol all eligible workers into a workplace pension automatically.